Buying life insurance is one of the most essential financial decisions to make as humans, yet, but not everyone is insured.

Why is it so essential? Simple, irrespective of how much you earn, no one knows what will be of tomorrow.

The rate at which people die via accident or illness is escalating. So many people die prematurely and it is even more painful if the person happens to be the breadwinner of the family. Family members and loved ones would suffer greatly from such a loss – as they may find it difficult to pay household expenses, debts and keep up their standard of living.

In order to save your family from going through these traumatic experiences, the best thing to do is to protect your family’s financial future by buying a life insurance policy.

Why do you need life insurance?

1 – Life Insurance Takes Care of The Family While You’re Gone

Your family members will still rely on you even after your demise; you don’t want to let them down. Do you? Either the money is used for replacing lost income, paying for your child’s tuition or ensuring that your spouse has financial security.

2 – Deals with Debt

After your demise, you certainly won’t want your family to be faced with financial liabilities during a problem. Every outstanding debt or loan will be taken care of if you happen to buy the correct life insurance policy.

3 – To Achieve Long-Term Goals

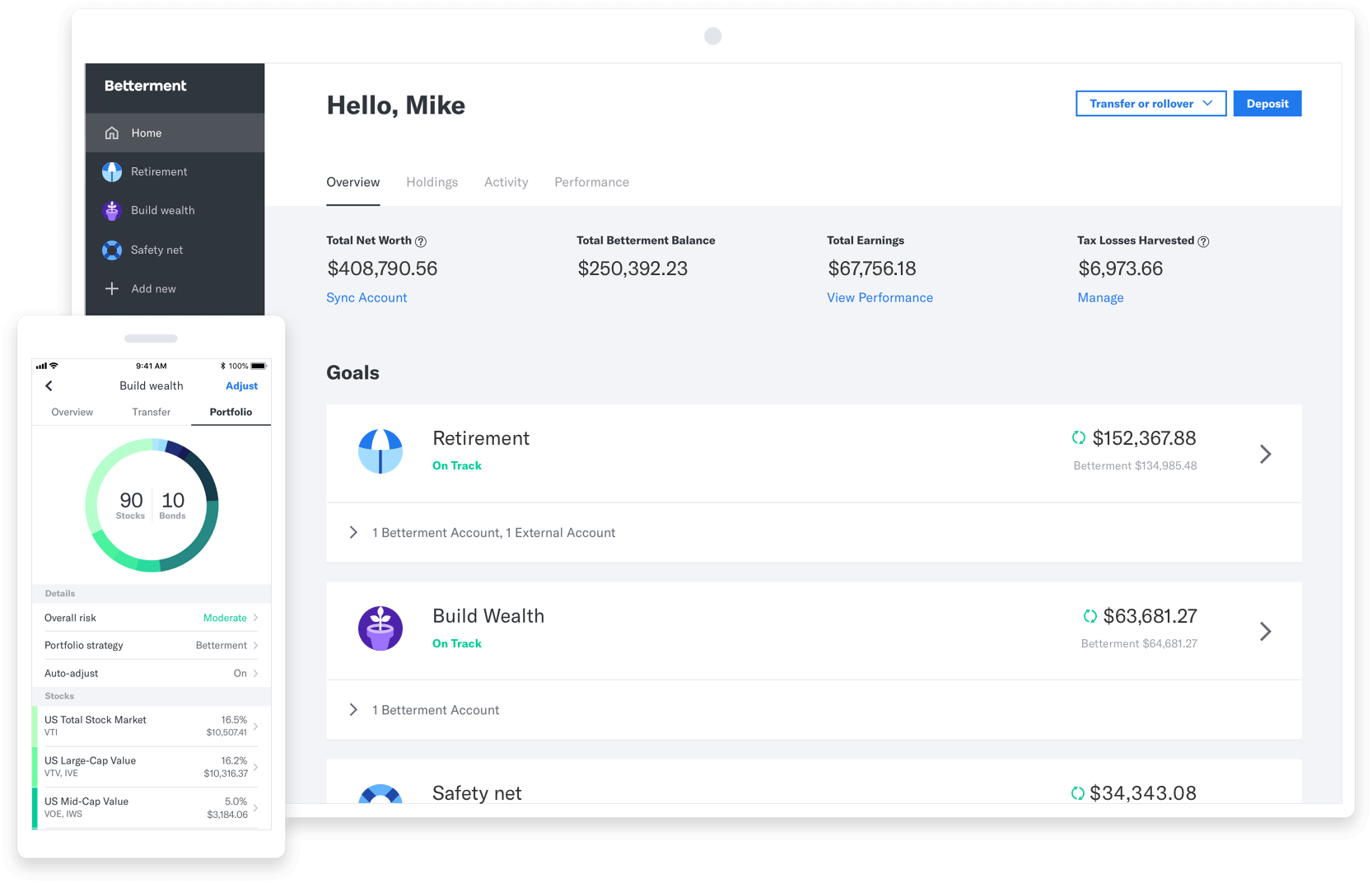

Life insurance helps you in accomplishing your long-term goals. For instance, buying a home of your own or planning towards your retirement. It also offers you different types of investment options with different policies.

4 – It Supplements Your Retirement Goals

Having a life insurance plan will ensure that you have a steady flow of income every month even after your retirement.

5 – Buying Insurance Is Cheaper For Younger Adults

If you’re still living off your parents’ income then, insurance may not be a priority. However, if you do have people dependent on you or you have co-signed a loan with your parents (or any other member of your family or friend), then you need to start reviewing options for a life insurance policy. Moreover, the coverage costs are much cheaper when you’re single & younger.

6 – Your Business is Also Covered

Life insurance is not only for you and your family only. Some insurance policies also take care of your business. If you have a business, then your business partner can buy your portion of the business without any fights or arguments.

7 – Tax-Saving Purposes

Regardless of the plan you buy, you can save taxes with insurance policies. The premium plan you pay on an insurance policy is qualified for a maximum tax benefit.

8 – Life Insurance Serves as a Means of Forced Savings

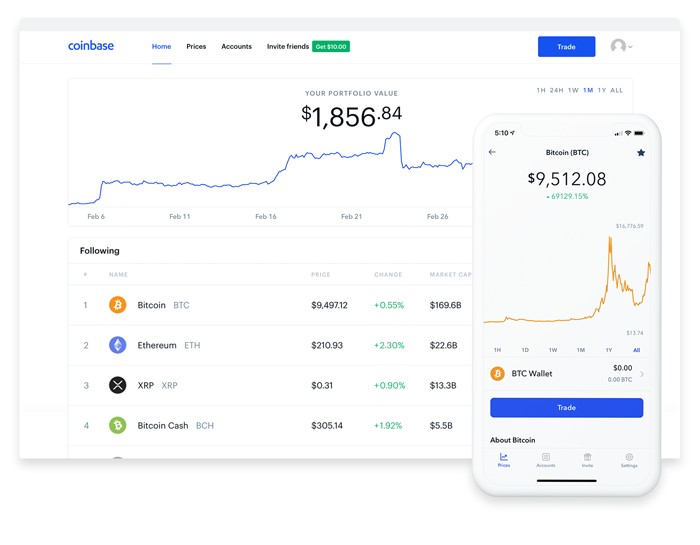

If you select a traditional or unit-linked policy, you pay a premium each month, which is more than what it costs to insure you. The extra money is invested and it accrues in cash value. This cash can later be borrowed against the policy or you can either sell it or get income from it.

9 – You May Not Be Qualified For it Later

Life insurance policies run on uncertainties. Being healthy will enable you to pay a premium for life insurance. Though it may seem to be an extra financial burden, if you suddenly fall sick, you may not be given the opportunity to purchase a life insurance policy. Therefore, it is important to buy one early on in your life.

10 – It Gives Peace of Mind

Death is inevitable! The best thing you can do for your family is to protect their financial future. Even though it is a small policy, you will have some peace of mind knowing that you’ve done all you can, to help them keep moving during difficult times.

Importance Of Life Insurance For Your Family

As we grow old, we get married, raise families and start businesses. We slowly realize that life insurance is an essential part of having a good financial plan. Depending on the type of policy you choose, life insurance is fairly inexpensive – this implies that you really have no excuse for not insuring.

What’s more, your family will also benefit from the following:

1 – Security of Family and Loved Ones

Life insurance is required from you if your family depends solely on your financial support for their means of livelihood. This is most essential for parents of young children or adults who would find it challenging to maintain their standard of living if they don’t have access to the income provided by their spouse. Life insurance easily replaces your income when you die.

2 – Leaves an Inheritance

Even if you left no inheritance for your children, you can create one in buying a life insurance policy and naming them as the beneficiaries. This is a great way to offer them any monetary needs that may arise, thus, securing their financial future.

3 – To Clear off Debts and Other Expenses

You don’t want your spouse, parents, children or other loved ones to be left with any extra financial burden along with the emotional pain they’re already experiencing. Your family needs insurance to settle any outstanding debt and any other expenses such as the costs for funeral and burial.

4 – To Ensure Extra Financial Security

Most parents like to ensure that their children will be properly taken care of after their demise. Quality education is not the only thing you want for them, but to also provide for other life ventures such as getting married, having children, buying their first home or starting a business. So, therefore, extra coverage is important while your children are still at home.

Issues That Come Up If You Don’t Have Life Insurance

Are there any consequences of not having life insurance? Yes, there are enormous consequences, written below are but a few:

1 – Leaving Your Family and Loved Ones in Financial Crisis

Your family and loved ones will be the ones to suffer the biggest consequence of you not having life insurance. If your family solely depends on you for their survival, they will be faced with a serious financial crisis.

2 – Leaving Your Family with Huge Debt

If you do not want your family to be embarrassed by recovery agents after your demise, you need to make essential planning for that. Why? Outstanding loans can be taken care of only if you buy the correct life insurance plan at the right time.

3 – Being Unprepared for Massive Expenses

If you have planned to leave your present job to start a business of your own, the only limitation you may experience is financial security. It will be dangerous for you not to have a financial back up before you take this bold step. Because when you’re faced with bigger expenses you will be able to maintain the financial state of your family even though you are not earning.

4 – Being Financially Dependent on Others in Old Age

If you do not want to be a liability for your grown-up children, you must start saving for retirement as early as possible. It will not only assure you of regular income flow for you, but it will also provide essential life insurance coverage as well.

5 – Not Being Able to Save Taxes

You work hard every day but a huge amount is always deducted whenever you received your monthly salary. If you do not want to lose your hard-earned money to tax, you should try to save income taxes as much as possible.

There is so much to benefit from life insurance and much more to lose from not insuring your life.

Life is unpredictable; no one knows when his/her clock will stop ticking.

Yes, we can’t avert death but the best thing you can do for for your family is set them up from the unexpected & life insurance will just make things a bit easier.

References:

10 reasons you need to buy life insurance by Aparna Chandrashekar

6 Consequences of Living a Life without Life Insurance Protection! By Entrepreneur India Staff

https://www.payoff.com/life/money/5-important-reasons-why-you-need-life-insurance/

5 Important Reasons Why You Need Life Insurance